|

Newsletter Highlights:

0 Comments

For generations, the homebuying process never really changed. The seller would try to estimate the market value of the home and tack on a little extra to give themselves some negotiating room. That figure would become the listing price of the house. Buyers would then try to determine how much less than the full price they could offer and still get the home. The asking price was generally the ceiling of the negotiation. The actual sales price would almost always be somewhat lower than the list price. It was unthinkable to pay more than what the seller was asking.

Today is different. The record-low supply of homes for sale coupled with very strong buyer demand is leading to a rise in bidding wars on many homes. Because of this, homes today often sell for more than the list price. In some cases, they sell for a lot more. According to the Home Buyers and Sellers Generational Trends report just released by the National Association of Realtors (NAR), 45% of buyers paid full price or more. You may need to change the way you look at the asking price of a home. In this market, you likely can’t shop for a home with the old-school mentality of refusing to pay full price or more for a house. Because of the shortage of inventory of houses for sale, many homes are actually being offered in an auction-like atmosphere in which the highest bidder wins the home. In an actual auction, the seller of an item agrees to take the highest bid, and many sellers set a reserve price on the item they’re selling. A reserve price is the minimum amount a seller will accept as the winning bid. When navigating a competitive housing market, think of the list price of the house as the reserve price at an auction. It’s the minimum the seller will accept in many cases. Today, the asking price is often becoming the floor of the negotiation rather than the ceiling. Therefore, if you really love a home, know that it may ultimately sell for more than the sellers are asking. So, as you’re navigating the homebuying process, make sure you know your budget, know what you can afford, and work with a trusted advisor who can help you make all the right moves as you buy a home. Bottom Line Someone who’s more familiar with the housing market of the past than that of today may think offering more for a home than the listing price is foolish. However, frequent and competitive bidding wars are creating an auction-like atmosphere in many real estate transactions. For the best advice on how to make a competitive offer on a home, reach out to a local real estate professional who’s an expert in your local market. www.keepingcurrentmatters.com Newsletter Highlights

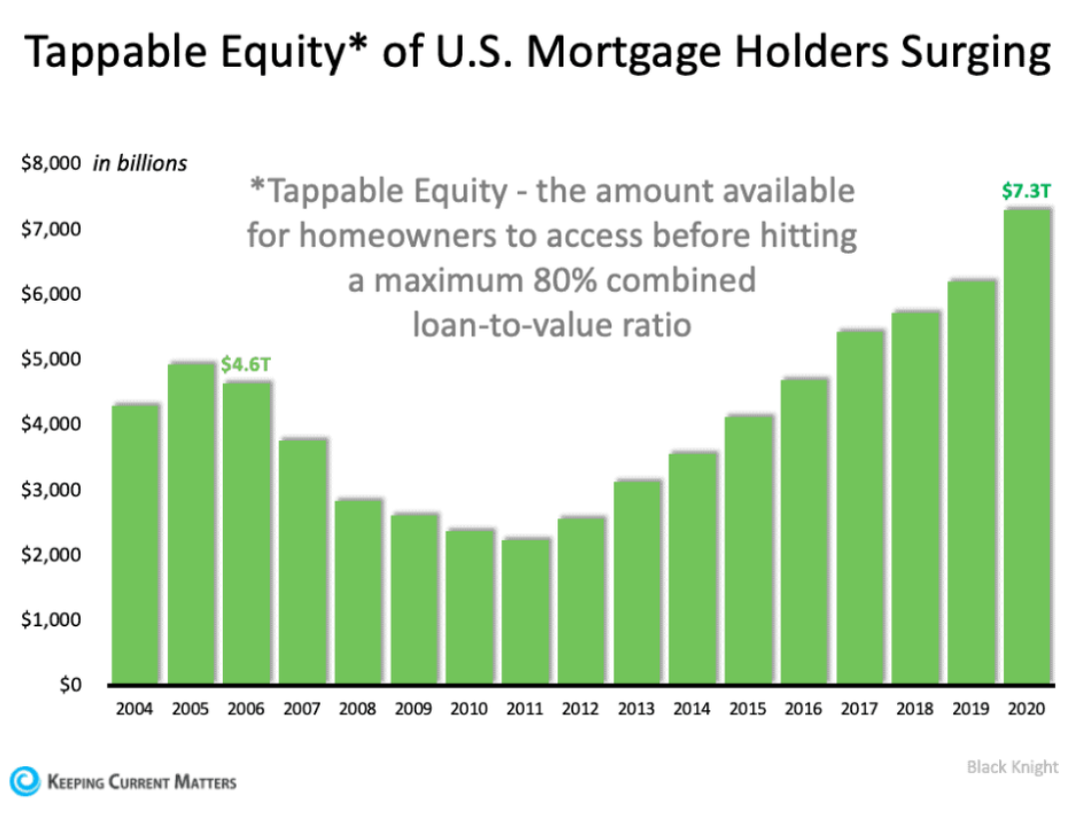

Freddie Mac recently released their Quarterly Refinance Statistics report which covers refinances through 2020. The report explains that the dollar amount of cash-out refinances was greater in 2020 than in recent years. A cash-out refinance, as defined by Investopia, is: “a mortgage refinancing option in which an old mortgage is replaced for a new one with a larger amount than owed on the previously existing loan, helping borrowers use their home mortgage to get some cash.” The Freddie Mac report led to articles like the one published by The Real Deal titled, House or ATM? Cash-Out Refinances Spiked in 2020, which reports: “Americans treated their homes like ATMs last year, withdrawing $152.7 billion amid a cash-out refinancing spree not seen since before the 2008 financial crisis.” Whenever you combine the terms “spiked,” “homes like ATMs,” and “financial crisis,” it conjures up memories of the housing crash we experienced in 2008. However, that comparison is invalid for three reasons: 1. Americans are sitting on much more home equity today. Mortgage data giant Black Knight just issued information on the amount of tappable equity U.S. homeowners with a mortgage have. Tappable equity is the amount of equity available for homeowners to use and still have 20% equity in their home. Here’s a graph showing the findings from their report: In 2006, directly before the crash, tappable home equity in the U.S. topped out at $4.6 trillion. Today, that number is $7.3 trillion. As Black Knight explains: “At year’s end, some 46 million homeowners held a total $7.3 trillion in tappable equity, the largest amount ever recorded…That’s an increase of more than $1.1 trillion (+18%) since the end of 2019, the largest percentage gain since 2013 and – you guessed it – the largest dollar value gain in history, to boot. All in all, it works out to roughly $158,000 on average per homeowner with tappable equity, up nearly $19,000 from the end of 2019.” 2. Homeowners cashed-out a much smaller amount this time. In 2006, Americans cashed-out a total of $321 billion. In 2020, that number was less than half, totaling $153 billion. The $321 billion made up 7% of the total tappable equity in the country in 2006. On the other hand, the $153 billion made up only 2% of the total tappable equity last year. 3. Fewer homeowners tapped their equity in 2020 than in 2006. Freddie Mac reports that 89% of refinances in 2006 were cash-out refinances. Last year, that number was less than half at 33%. As a percentage of those who refinanced, many more Americans lowered their equity position fifteen years ago as compared to last year. Bottom Line It’s true that many Americans liquidated a portion of the equity in their homes last year for various reasons. However, less than half of them tapped their equity compared to 2006, and they cashed-out less than one-third of that available equity. Today’s cash-out refinance situation bears no resemblance to the situation that preceded the housing crash. Newsletter Highlights:

I am proud to be named one of the Top 50 New Hampshire Real Estate Agents On Social Media! This award is super special to me because the proper marketing of your property is crucial when selling your home. I pride myself on utilizing various marketing techniques to highlight my clients property to provide them with the best exposure to potential buyers (ESPECIALLY social media!)

Read the full article by clicking on the image below: Highlights from the newsletter this week include listings in Hampstead, the February Market Report, maple sugaring, ten dogs looking for a home, and my latest YouTube video. Click on the image to read it online.

Highlights from the newsletter this week include exp featured listings, 3 FREE guides, my favorite tailor in Salem, a siamese cat looking for a home, and a video about an historic NH tax incentive. Read it HERE or click on the image below:

|